About the conference

REAL ESTATE’S CONTINUING RESILIENCE.

What’s behind it and where’s it going?

The real estate market is facing significant changes, affected by rising construction costs, economic turbulence, regional geopolitical risks, etc. Availability and cost of financing also play an important role in shaping the commercial real estate outlook. The global pandemic has additionally accelerated changes in consumer behavior, which will impact the real estate market.

In recent years, Europe has witnessed dramatic growth in multi-family housing investment. This is driven by a rise in international capital and a changing capital base. Multi-family housing is now the largest asset class in the European real estate investment market, confirming the noise coming out of the listed sector and proving that investors are increasingly seeing multi-family as a safer bet. From a geographical point of view, it seems that investors are increasingly focused on core markets. However, higher yields may attract more and more investors to the Baltic region.

With a lack of residential supply, which does not correspond to the peaking demand, prices in the Baltics have skyrocketed. Other factors have also influenced growth, including but not limited to, delayed construction permits, new infrastructure costs, increasing purchasing power, the attractive debt financing environment, and price speculation in the market. Demand for housing in the primary market is so high that developers are no longer able to meet it. There is evidence of acquisition from plans prior to the practical completion of buildings, as well as switching demand, even for secondary locations. With rent growth lagging behind inflation rates, the residential rental market is expected to show significant gains soon. More and more developers and investors are considering co-living and micro-living concepts in the Baltic region, as well.

Hotels have also been a widely discussed asset class. While tourism was highly affected by the pandemic, the sector’s recovery positively correlated with the ease of restrictions. Therefore, investment in hotel development was quite active.

Dienas Bizness Publishing House in collaboration with CBRE Baltics and real estate market experts are holding the real estate sector conference which will take place in Business Garden Riga on 15th September, 2022 to discuss the current situation in the industry, perspectives for 2023, and the challenges in the Baltic real estate market. The core focus of the conference will be placed on Riga city development and its potential, as well as residential and hospitality sectors in Baltics.

Reserve your place to guarantee in-person attendance and networking in the business centre (pre-booked meeting rooms will be available during the conference).

The conference will be also broadcasted online.

Target audience: real estate developers and representatives from the industry, business managers, as well as representatives and executives from construction, municipalities, and state institutions.

Time and venue: 15th September 2022 | Business Garden Riga, 2 Malduguņu Street, Marupe and online

Conference languages: English and Latvian

PARTICIPATION:

When registering, please indicate whether you will participate in the event in person or watch the conference online – the price does not change.

A single ticket : EUR 360 + VAT

30% discount for CBRE corporate clients and partners, Dienas Bizness subscribers: EUR 252 + VAT

Please book your seat here!

More about the event:

Santa Butane

+37126132470

santa.butane@db.lv

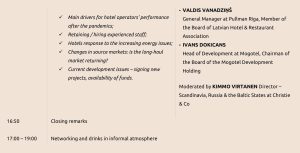

Programme

Experts

Registration

Error: Contact form not found.